Palin stops in Fla. town that feted her in 2008

By BRENDAN FARRINGTON, AP Political Writer

Tue Nov 24, 5:45 pm ET

THE VILLAGES, Fla. – Sarah Palin, who says the 2012 presidential election isn't on her radar, took her "Going Rogue" book tour to the biggest of the battleground states Tuesday, including a stop in the retirement community where tens of thousands of people gave her star treatment in the 2008 presidential election.

The crowd was far smaller than when she made a September 2008 campaign stop as Republican John McCain's running mate, but no less passionate for the former Alaska governor. About 700 people, some who arrived a full 24 hours before the signing, waited for Palin as country music blared. Several signs encouraged her to run for president in 2012.

When she arrived, the crowd chanted "Sarah! Sarah!" She made brief remarks — including a gleeful "You can read my story thus far — unfiltered by the media!" She sat down to a Fox News interview, during which there were shouts of "We love you Sarah! We love you and we want you to be president!" and, "Take back the Constitution! And the Bill of Rights!"

The Villages is a massive, heavily Republican retirement community about 60 miles northwest of Orlando that draws huge crowds for political events. About a month after McCain picked her as his running mate, a crowd that would make some college football teams envious sweated for hours in 92-degree heat to hear her speak for 23 minutes. Some waited 90 minutes for a parking space.

Palin remembered the day.

"Oh my goodness this is a blast," she said. "We had such a great time here on the campaign trail. We said, 'If we ever come back to Florida we have to make sure that we're stopping here.' There's something very special about this place. You just are all so energetic and so inspiring and encouraging."

The feeling was mutual for those waiting for a signature.

"I haven't been eating properly, I couldn't sleep last night at all. I was too excited," said Victoria Dye, 81, of Richfield Springs, N.Y., who is wintering in The Villages. Dye arrived at Barnes & Noble at 6:45 p.m. Monday planning to buy the book and return the next day, but then she saw people already lined up. "I said, 'Well, I guess I better get a chair."

Her friend went home to get the chair while Dye stayed on the sidewalk.

"She's the ultimate woman. She is an amazing human being. I like everything she says and she speaks with sincerity," said Dye, a Republican. "I know good politicians and I know bad ones. She happens to be a good one."

Linda Garrison, 59, splits her years between a house in The Villages and a home in Anchorage, Alaska. She has bumped into Palin at a used clothing store and other events back home, but still slept on the concrete to be one of the first people in line to get her book signed.

"You'd see her in there shopping just like anybody else. You see, Alaska is a different type of a state. You can pick up the phone and personally talk to the governor without too much hassle," Garrison said.

So why sleep on a sidewalk to get her signature? "It's a matter of respect," she said.

Unlike most people at the event, Garrison, a Republican, wasn't sure she wanted Palin to run for president in 2012. She thinks it might be better if she waits until 2016.

"It's very hard to defeat an incumbent, no matter what the economy is doing," she said. "It might not be her time in 2012. That might just be a little premature. She is still a young woman. I hope at some point she runs."

University of South Florida political science professor Susan MacManus walked through the crowd talking to people to get a sense of why they loved Palin.

"They're just angry at government and Sarah Palin to them is someone who can speak her mind and she's not part of the establishment," MacManus said. "She represents in their minds their viewpoint about what's wrong with government."

Palin also had stops in Jacksonville and Orlando.

Copyright © 2009 Yahoo! Inc. All rights reserved.

25 November 2009

22 November 2009

Ave Maria Newspaper -- all the news that's fit to print....

[[Imagine -- a developer is excited about his own development and optimistic about its success!]]

Pulte Homes "Really Positive" About Future of Ave Maria

Friday, 20 November 2009 15:37

Pulte Homes is making significant new commitments to marketing areas of Ave Maria, the company's president for Southwest Florida, Ryan Marshall, told The Ave Herald.

The first new initiative, Mr. Marshall said, is introducing 10 new models for the town's Del Webb section. Model homes will be built in an area where Pulte has broken ground next to the golf course, behind the cafe (right, in photo by Jo Ellen Monahan)

"We are really positive about the future of the community and see it as a long-term investment," Mr. Marshall said. Del Webb is the company's immediate priority for Ave Maria, Mr. Marshall said, because the "active adult" market has proven to be more resilient to the decline in the housing market overall....

-- For the rest of the article, please visit this link:

http://www.aveherald.com/news/435-pulte-homes-qreally-positiveq-about-future-of-ave-maria.html

Pulte Homes "Really Positive" About Future of Ave Maria

Friday, 20 November 2009 15:37

Pulte Homes is making significant new commitments to marketing areas of Ave Maria, the company's president for Southwest Florida, Ryan Marshall, told The Ave Herald.

The first new initiative, Mr. Marshall said, is introducing 10 new models for the town's Del Webb section. Model homes will be built in an area where Pulte has broken ground next to the golf course, behind the cafe (right, in photo by Jo Ellen Monahan)

"We are really positive about the future of the community and see it as a long-term investment," Mr. Marshall said. Del Webb is the company's immediate priority for Ave Maria, Mr. Marshall said, because the "active adult" market has proven to be more resilient to the decline in the housing market overall....

-- For the rest of the article, please visit this link:

http://www.aveherald.com/news/435-pulte-homes-qreally-positiveq-about-future-of-ave-maria.html

09 November 2009

Lawsuit alleges discrimination at Idaho Active Adult development

Idaho Business Review

Lawsuit claims federal fair housing law violations

Posted: Monday, November 9, 2009

The Intermountain Fair Housing Council is suing The Orchards at Fairview Condominium Association, claiming the company and its real estate firm violated federal housing discrimination laws two years after the council explicitly warned the developer about the marketing of the condo project.

The council, a Boise-based nonprofit, filed a lawsuit in federal court Oct. 15 against the association and real estate firm Windermere Real Estate/ Capital Group Inc.

The suit alleges that the companies violated the Fair Housing Act by pitching the development as an “active adult community” and discouraging families with children from living there. It also says the development maintained an unlawful restriction on group homes that would serve the mentally and physically disabled.

The Fair Housing Act prohibits discrimination based on familial status or handicap in the sale and rental of homes.

“There’s no such thing as an ‘active adult community’ to be advertised,” said Richard Mabbutt, the council’s executive director, in an interview. “We discussed that quite frankly.”

Court papers say Mabbutt contacted and met with Orchards developer Mike Dixon after an Oct. 5, 2005 article in the Idaho Statesman described the property as “a 42-unit ‘empty nester’ subdivision.”

Dixon told Mabbutt the term “empty nester” was “the reporter’s choice of words” and that the development was open to families with minor children and not age-restricted, court papers say. He also said the property would include a playground even though the site plans didn’t include one.

Mabbutt warned against use of the word “adult” in advertising and other materials.

A March 7, 2005 article in the Idaho Business Review also included a comment from Dixon that described the condos as “suited for the empty-nester market.”

On May 14, 2007, Mabbutt saw a sign on the property that described it as an “active adult condominium community.” That prompted him to send several testers to the property to investigate if there was a pattern of discrimination.

On May 16, 2007, a tester met with Mary Liese, a Windermere agent who was handling the sale of units at the time. The suit claims that Liese made discriminatory statements, such as “we prefer people 55 and over,” and noted that the complex does not have a playground. She also provided a list of rules that included a prohibition on swing sets, unaccompanied minor children using the pool and teenage parties at the community center.

Another tester returned a week later and picked up a document listing the complex’s covenants, conditions and restrictions, which included a prohibition on “group homes … or any similar type of lodging, care or treatment facility.”

The council filed an administrative complaint with the U.S. Department of Housing and Urban Development on Sept. 7, 2007. It withdrew the complaint on Jan. 24, 2008 so it could later file the lawsuit.

The suit is seeking $56,000 in actual and punitive damages and $34,500 in other expenses. It also asks for the establishment of a $273,500 victims’ compensation fund to repay unidentified victims.

Steve Osburn, Windermere broker and owner, said in a statement that his company represented the Orchards complex for a two-year period starting in about January 2007. He said Windermere successfully sold homes to people of all ages and familial status and that a pattern of discrimination never existed.

He said the lawsuit’s claims about Liese are “simply false” and that she denies making discriminatory statements.

“Furthermore, we only get paid when we successfully close a sale,” he said. “What motivation would Ms. Liese have to limit potential buyers as they suggest?”

The Orchards at Fairview was built on the site of a former BMC West warehouse and includes single-story condos ranging from 1,271 to 1,935 square feet, a clubhouse and pool. Dixon sold the Fairview complex and a similar development, The Orchards at Cloverdale, to partners Mike Keller and Ev Davis in 2008.

A message left with the Orchards was not returned.

Ken Nagy, the lawyer representing the council, said there is a way for communities to be set up as age-restricted under the Fair Housing Act.

“They have to do that consistently, and they have to be set up that way,” he said. “This community didn’t do it that way. It has consistently marketed itself as a community that is attractive to an older group of residents, and they were warned early on about that.”

© 2009 Idaho Business Review

Lawsuit claims federal fair housing law violations

Posted: Monday, November 9, 2009

The Intermountain Fair Housing Council is suing The Orchards at Fairview Condominium Association, claiming the company and its real estate firm violated federal housing discrimination laws two years after the council explicitly warned the developer about the marketing of the condo project.

The council, a Boise-based nonprofit, filed a lawsuit in federal court Oct. 15 against the association and real estate firm Windermere Real Estate/ Capital Group Inc.

The suit alleges that the companies violated the Fair Housing Act by pitching the development as an “active adult community” and discouraging families with children from living there. It also says the development maintained an unlawful restriction on group homes that would serve the mentally and physically disabled.

The Fair Housing Act prohibits discrimination based on familial status or handicap in the sale and rental of homes.

“There’s no such thing as an ‘active adult community’ to be advertised,” said Richard Mabbutt, the council’s executive director, in an interview. “We discussed that quite frankly.”

Court papers say Mabbutt contacted and met with Orchards developer Mike Dixon after an Oct. 5, 2005 article in the Idaho Statesman described the property as “a 42-unit ‘empty nester’ subdivision.”

Dixon told Mabbutt the term “empty nester” was “the reporter’s choice of words” and that the development was open to families with minor children and not age-restricted, court papers say. He also said the property would include a playground even though the site plans didn’t include one.

Mabbutt warned against use of the word “adult” in advertising and other materials.

A March 7, 2005 article in the Idaho Business Review also included a comment from Dixon that described the condos as “suited for the empty-nester market.”

On May 14, 2007, Mabbutt saw a sign on the property that described it as an “active adult condominium community.” That prompted him to send several testers to the property to investigate if there was a pattern of discrimination.

On May 16, 2007, a tester met with Mary Liese, a Windermere agent who was handling the sale of units at the time. The suit claims that Liese made discriminatory statements, such as “we prefer people 55 and over,” and noted that the complex does not have a playground. She also provided a list of rules that included a prohibition on swing sets, unaccompanied minor children using the pool and teenage parties at the community center.

Another tester returned a week later and picked up a document listing the complex’s covenants, conditions and restrictions, which included a prohibition on “group homes … or any similar type of lodging, care or treatment facility.”

The council filed an administrative complaint with the U.S. Department of Housing and Urban Development on Sept. 7, 2007. It withdrew the complaint on Jan. 24, 2008 so it could later file the lawsuit.

The suit is seeking $56,000 in actual and punitive damages and $34,500 in other expenses. It also asks for the establishment of a $273,500 victims’ compensation fund to repay unidentified victims.

Steve Osburn, Windermere broker and owner, said in a statement that his company represented the Orchards complex for a two-year period starting in about January 2007. He said Windermere successfully sold homes to people of all ages and familial status and that a pattern of discrimination never existed.

He said the lawsuit’s claims about Liese are “simply false” and that she denies making discriminatory statements.

“Furthermore, we only get paid when we successfully close a sale,” he said. “What motivation would Ms. Liese have to limit potential buyers as they suggest?”

The Orchards at Fairview was built on the site of a former BMC West warehouse and includes single-story condos ranging from 1,271 to 1,935 square feet, a clubhouse and pool. Dixon sold the Fairview complex and a similar development, The Orchards at Cloverdale, to partners Mike Keller and Ev Davis in 2008.

A message left with the Orchards was not returned.

Ken Nagy, the lawyer representing the council, said there is a way for communities to be set up as age-restricted under the Fair Housing Act.

“They have to do that consistently, and they have to be set up that way,” he said. “This community didn’t do it that way. It has consistently marketed itself as a community that is attractive to an older group of residents, and they were warned early on about that.”

© 2009 Idaho Business Review

04 November 2009

Trend: No Trick or Treating at many 55+ Adult Communities

orlandosentinel.com/news/local/orl-halloween-how-to-103109,0,3378089.story

OrlandoSentinel.com

Halloween how-to: Try these tricks so you can enjoy treats

Linda Shrieves

Sentinel Staff Writer

October 31, 2009

Halloween may be a kid's favorite holiday (after Christmas, of course). Kids know what to do, but what about adults? Here's the skinny on the hottest neighborhoods for trick-or-treating, the best treats and what time it's OK to turn out the lights.

Best trick-or-treating areas

Live in a neighborhood where there aren't many trick-or-treaters — or people handing out candy? You can head to malls or community events — or follow the lead of candy-hungry trick-or-treaters and head for well-heeled communities with reputations for giving out more chocolate and less candy corn. Not that we'd do that (because frankly, it's a pain to drive around with kids on a sugar high) but some choice neighborhoods include Celebration, Hunter's Creek or Waterford Lakes (where there are more kids per capita than any other place in Central Florida). Translation: They're used to kids there.

One of the best

Dommerich Hills in Maitland, where the streets are teeming with kids. For years, the neighbors in this subdivision have put on what appears to be one heck of a street party. Said resident John Deroo: "It's the biggest neighborhood party I've ever seen. One guy has a popcorn machine; another guy makes snow cones. They all try to outdo each other."

Trick-or-treating deluxe

In Isleworth, the ritzy subdivision that's home to Tiger Woods and Shaquille O'Neal, the mansions are so far apart that kiddies in costume go trick-or-treating in golf carts. Not only do they dress up the kids, but some families also decorate their carts — as the Flintstones' mobile or a circus train, replete with clowns.

Trick-or-treating to the oldies

Thinking about trick-or-treating in a 55-plus community? Fuhgeddaboutit. Even The Villages, the huge retirement community in Lake and Sumter counties, stopped having its annual trick-or-treating event for kids several years ago. "I don't see too many kids around here," said one employee. "Except when the grandkids are visiting."

Are you ever too old to trick or treat?

Apparently not. In an informal e-mail survey of moms, we found none would turn away teens or college students — as long as they are dressed in costume. Even those who show up at her doorstep without a costume get some candy, said Orlando mom Barbara Jones, though it "may be something my daughter got and does not like."

Candy or healthy goodies?

Are you handing out raisins or apples or little bags of peanuts? Good for you, but you're in the minority. Eighty-two percent of Americans hand out bite-size candy bars and 45 percent hand out multiple types of candy treats, such as miniature candy bars, lollipops, gummy candy and non-chocolate candies, according to marketing firm NPD Group. Breaking from that tradition is Gail Hill Smith, an Orlando mom and health counselor, who hands out boxes of raisins, peanuts in shells and individually wrapped toothbrushes. (Don't egg her house, please.)

Be prepared, people

Most Americans say they buy enough candy to prepare for Halloween. But 25 percent admit they often run out of treats. When the supply of candy runs out, they either turn off the porch lights and refuse to answer the door, or they run out to buy more, or scavenge around for other food or coins to hand out. And, yes, some hand out the candy their kids have just collected. (Shame on you, parents!)

Lights out!

What's an acceptable time to turn off the porch light and douse the jack-o'-lantern? Local moms turn off the lights around 9 p.m., sometimes a little later if Halloween falls on a weekend (as it does this year).

Linda Shrieves can be reached at 407-420-5433 or lshrieves@orlandosentinel.com.

Copyright © 2009, Orlando Sentinel

OrlandoSentinel.com

Halloween how-to: Try these tricks so you can enjoy treats

Linda Shrieves

Sentinel Staff Writer

October 31, 2009

Halloween may be a kid's favorite holiday (after Christmas, of course). Kids know what to do, but what about adults? Here's the skinny on the hottest neighborhoods for trick-or-treating, the best treats and what time it's OK to turn out the lights.

Best trick-or-treating areas

Live in a neighborhood where there aren't many trick-or-treaters — or people handing out candy? You can head to malls or community events — or follow the lead of candy-hungry trick-or-treaters and head for well-heeled communities with reputations for giving out more chocolate and less candy corn. Not that we'd do that (because frankly, it's a pain to drive around with kids on a sugar high) but some choice neighborhoods include Celebration, Hunter's Creek or Waterford Lakes (where there are more kids per capita than any other place in Central Florida). Translation: They're used to kids there.

One of the best

Dommerich Hills in Maitland, where the streets are teeming with kids. For years, the neighbors in this subdivision have put on what appears to be one heck of a street party. Said resident John Deroo: "It's the biggest neighborhood party I've ever seen. One guy has a popcorn machine; another guy makes snow cones. They all try to outdo each other."

Trick-or-treating deluxe

In Isleworth, the ritzy subdivision that's home to Tiger Woods and Shaquille O'Neal, the mansions are so far apart that kiddies in costume go trick-or-treating in golf carts. Not only do they dress up the kids, but some families also decorate their carts — as the Flintstones' mobile or a circus train, replete with clowns.

Trick-or-treating to the oldies

Thinking about trick-or-treating in a 55-plus community? Fuhgeddaboutit. Even The Villages, the huge retirement community in Lake and Sumter counties, stopped having its annual trick-or-treating event for kids several years ago. "I don't see too many kids around here," said one employee. "Except when the grandkids are visiting."

Are you ever too old to trick or treat?

Apparently not. In an informal e-mail survey of moms, we found none would turn away teens or college students — as long as they are dressed in costume. Even those who show up at her doorstep without a costume get some candy, said Orlando mom Barbara Jones, though it "may be something my daughter got and does not like."

Candy or healthy goodies?

Are you handing out raisins or apples or little bags of peanuts? Good for you, but you're in the minority. Eighty-two percent of Americans hand out bite-size candy bars and 45 percent hand out multiple types of candy treats, such as miniature candy bars, lollipops, gummy candy and non-chocolate candies, according to marketing firm NPD Group. Breaking from that tradition is Gail Hill Smith, an Orlando mom and health counselor, who hands out boxes of raisins, peanuts in shells and individually wrapped toothbrushes. (Don't egg her house, please.)

Be prepared, people

Most Americans say they buy enough candy to prepare for Halloween. But 25 percent admit they often run out of treats. When the supply of candy runs out, they either turn off the porch lights and refuse to answer the door, or they run out to buy more, or scavenge around for other food or coins to hand out. And, yes, some hand out the candy their kids have just collected. (Shame on you, parents!)

Lights out!

What's an acceptable time to turn off the porch light and douse the jack-o'-lantern? Local moms turn off the lights around 9 p.m., sometimes a little later if Halloween falls on a weekend (as it does this year).

Linda Shrieves can be reached at 407-420-5433 or lshrieves@orlandosentinel.com.

Copyright © 2009, Orlando Sentinel

02 November 2009

Awakening the inner "frisky" -- from a NJ newspaper...

November 1, 2009

Being frisky at 70 isn't a problem

Dear Dr. Marcia: My husband of 45 years and I are pushing 70. When we retired a few years ago, we moved to an active-adult community, and we've never felt better. We're in great shape and exercise every day.

This has made my husband quite frisky, and even when we are out with friends, he jokes about how "active" we are and is always grabbing me and joking around. I get embarrassed, but he doesn't care. Even our adult kids tell him they don't want to know.

What can I do?

-- Sincerely, Blushing

Dear Blushing: Please tell me you wrote this to brag, because if you didn't, you must be kidding! Tell your kids to deal with it. Any of your friends who think it's disgusting are just jealous.

Enjoy!

Being frisky at 70 isn't a problem

Dear Dr. Marcia: My husband of 45 years and I are pushing 70. When we retired a few years ago, we moved to an active-adult community, and we've never felt better. We're in great shape and exercise every day.

This has made my husband quite frisky, and even when we are out with friends, he jokes about how "active" we are and is always grabbing me and joking around. I get embarrassed, but he doesn't care. Even our adult kids tell him they don't want to know.

What can I do?

-- Sincerely, Blushing

Dear Blushing: Please tell me you wrote this to brag, because if you didn't, you must be kidding! Tell your kids to deal with it. Any of your friends who think it's disgusting are just jealous.

Enjoy!

Poignant reader email -- one of my favorites

Dear Mr. Blechman,

I just finished reading “Leisureville” and I’d like to thank you for writing such an intelligent and entertaining book. Your work reminds me of Joel Garreau’s “Edge City” insofar as it strains to describe a phenomenon in a balanced way while still making your own concerns quite clear. As much as I enjoy James Howard Kunstler’s rants, he’s never been accused of moderation, but that’s what makes him so endearing. There were also hints of Jane Jacobs' later works, "Systems of Survival" and "Dark Age Ahead". “Leisureville” closely resembles a geriatric version of Setha Low’s “Behind the Gates” (although I admit your writing style is a bit better). Ms. Low was primarily concerned with the social and political fragmentation and mistrust that inevitably results from the self-segregation of gated suburban enclaves.

As a young man I fled the suburbs of the Jersey shore and ultimately settled in San Francisco. A few weeks ago I returned to Toms River, New Jersey to visit my mother who now lives in Holiday City. I talked to her about how she likes her new living arrangement. She said it was a mixed bag. Safe. Clean. Affordable. Lonely. Dull. Restrictive. She confirmed all the stereotypes about sex-crazed neighbors and rule obsessed committees. I had lobbied very hard for her to come and live with me in California citing the cultural offerings and free accommodations, but she ultimately wanted to stay near my sisters and brother and all the grandkids in Jersey. She also wanted to live independently. Fair enough.

As an adolescent I had plenty of contact with the elderly residents of these ever-expanding adult communities. I did housekeeping and gardening chores for many retirees as a way to earn money for college (Rutgers ’96). I enjoy the company of old people so it was a good fit. And to be honest, the generation I was dealing with back then was more likable than the new crop of boomers. They were savers and planners. They had survived the Depression and war. They told stories of how they were smuggled out of Poland “just in time”, or described burning their dining room furniture one piece at a time to keep their Brooklyn tenement warm through the winter. These people didn’t need plastic surgery or granite counter tops. They appreciated the fact that they had good food, a tidy home in the country, and money in the bank at a time in life when their own parents had been destitute. Boomers? Not so much…

I have very few fond memories of my early years in the suburbs. My family was working class and just barely managed to stay afloat. The suburbs are predicated on the concept that if you can't afford your own detached home and private vehicle, you don't belong. Public transport is considered a form of communism. Suburbia is a pay-per-view environment: private country clubs, summer camp, dance lessons, music lessons. Even the beaches in New Jersey are privately owned and charge admission. We couldn't afford any of that. To save money for college I rode a bicycle everywhere and I can't tell you how many times as a young man I was pulled over by the police and questioned. I would ask what I had done wrong, and they would always say that riding a bicycle along the highway, especially after dark or in bad weather, was suspicious. The unspoken message was that only the poor and undesirables do that sort of thing, so they needed to see what was in my backpack. Books usually. They always seemed so befuddled and sent me on my way with a warning. Nerd. Guilty as charged...

I hadn’t been back to Toms River for fifteen years. (I preferred to pay for airline tickets so my mom could visit me in California instead). I was reminded why I left. When I was a kid, the small historic downtown of Toms River still had a working movie theater, a shoe store, restaurants, and a dress shop. All that fell away by the time I graduated high school as strip malls and chain stores chewed up the landscape outside of town. The only things that remained were the government buildings since Toms River was the county seat. Now, most of the old buildings aren’t even there anymore. Little by little they were removed as the roads were widened and parking lots were installed. Downtown is just another kind of mall now, this one devoted to municipal services. Two hundred years of history were paved over so commuters could get through town and make a right hand turn forty five seconds faster.

When I express my concerns about sprawl people often suggest that San Francisco is an anomaly and out of step with how most Americans want to live. After all, nothing like a compact mixed use city has been built anywhere in the country for a hundred years now. I respond by saying that a hundred years from now San Francisco will still be well populated and vibrant. I don’t think the same will be true of most cul de sacs and strip malls. Most of the suburbs will have become mulch by then.

Again, many thanks for your good work.

- John S.

I just finished reading “Leisureville” and I’d like to thank you for writing such an intelligent and entertaining book. Your work reminds me of Joel Garreau’s “Edge City” insofar as it strains to describe a phenomenon in a balanced way while still making your own concerns quite clear. As much as I enjoy James Howard Kunstler’s rants, he’s never been accused of moderation, but that’s what makes him so endearing. There were also hints of Jane Jacobs' later works, "Systems of Survival" and "Dark Age Ahead". “Leisureville” closely resembles a geriatric version of Setha Low’s “Behind the Gates” (although I admit your writing style is a bit better). Ms. Low was primarily concerned with the social and political fragmentation and mistrust that inevitably results from the self-segregation of gated suburban enclaves.

As a young man I fled the suburbs of the Jersey shore and ultimately settled in San Francisco. A few weeks ago I returned to Toms River, New Jersey to visit my mother who now lives in Holiday City. I talked to her about how she likes her new living arrangement. She said it was a mixed bag. Safe. Clean. Affordable. Lonely. Dull. Restrictive. She confirmed all the stereotypes about sex-crazed neighbors and rule obsessed committees. I had lobbied very hard for her to come and live with me in California citing the cultural offerings and free accommodations, but she ultimately wanted to stay near my sisters and brother and all the grandkids in Jersey. She also wanted to live independently. Fair enough.

As an adolescent I had plenty of contact with the elderly residents of these ever-expanding adult communities. I did housekeeping and gardening chores for many retirees as a way to earn money for college (Rutgers ’96). I enjoy the company of old people so it was a good fit. And to be honest, the generation I was dealing with back then was more likable than the new crop of boomers. They were savers and planners. They had survived the Depression and war. They told stories of how they were smuggled out of Poland “just in time”, or described burning their dining room furniture one piece at a time to keep their Brooklyn tenement warm through the winter. These people didn’t need plastic surgery or granite counter tops. They appreciated the fact that they had good food, a tidy home in the country, and money in the bank at a time in life when their own parents had been destitute. Boomers? Not so much…

I have very few fond memories of my early years in the suburbs. My family was working class and just barely managed to stay afloat. The suburbs are predicated on the concept that if you can't afford your own detached home and private vehicle, you don't belong. Public transport is considered a form of communism. Suburbia is a pay-per-view environment: private country clubs, summer camp, dance lessons, music lessons. Even the beaches in New Jersey are privately owned and charge admission. We couldn't afford any of that. To save money for college I rode a bicycle everywhere and I can't tell you how many times as a young man I was pulled over by the police and questioned. I would ask what I had done wrong, and they would always say that riding a bicycle along the highway, especially after dark or in bad weather, was suspicious. The unspoken message was that only the poor and undesirables do that sort of thing, so they needed to see what was in my backpack. Books usually. They always seemed so befuddled and sent me on my way with a warning. Nerd. Guilty as charged...

I hadn’t been back to Toms River for fifteen years. (I preferred to pay for airline tickets so my mom could visit me in California instead). I was reminded why I left. When I was a kid, the small historic downtown of Toms River still had a working movie theater, a shoe store, restaurants, and a dress shop. All that fell away by the time I graduated high school as strip malls and chain stores chewed up the landscape outside of town. The only things that remained were the government buildings since Toms River was the county seat. Now, most of the old buildings aren’t even there anymore. Little by little they were removed as the roads were widened and parking lots were installed. Downtown is just another kind of mall now, this one devoted to municipal services. Two hundred years of history were paved over so commuters could get through town and make a right hand turn forty five seconds faster.

When I express my concerns about sprawl people often suggest that San Francisco is an anomaly and out of step with how most Americans want to live. After all, nothing like a compact mixed use city has been built anywhere in the country for a hundred years now. I respond by saying that a hundred years from now San Francisco will still be well populated and vibrant. I don’t think the same will be true of most cul de sacs and strip malls. Most of the suburbs will have become mulch by then.

Again, many thanks for your good work.

- John S.

25 September 2009

Reader email (from an architect designing integrated housing)

Dear Mr. Blechman:

I wanted to drop you a quick note to let you know how much I enjoyed reading Leisureville. It was humorous while raising very real concerns about how we as a society engage, or disengage, with each other especially during the retirement years.

As an Architect on Cape Cod who designs a wide range of community facilities (ie, community & senior centers, libraries, churches etc..) and housing from modest single family homes to multi-unit and affordable housing developments, I am always interested in housing trends and the social forces which affect the design process and how people live, work and socialize.

Our firm has had the good fortune over the last few years to have aligned with a local non-profit housing developer (Housing Assistance Corp.) to design and build several housing developments and our team discussions are always about "fostering community" among the "age integrated" residents and building well designed and environmentally responsible housing.

After reading your book, it made me appreciate all the more that we are living in and developing real community buildings and housing for real people "warts and all". Developing affordable housing for lower income individuals and families is a real challenge and NIMBYism, even here on Cape Cod is alive and well. Your book has helped to re-energize my work.

Sincerely.

Rick F

Yarmouthport, MA

I wanted to drop you a quick note to let you know how much I enjoyed reading Leisureville. It was humorous while raising very real concerns about how we as a society engage, or disengage, with each other especially during the retirement years.

As an Architect on Cape Cod who designs a wide range of community facilities (ie, community & senior centers, libraries, churches etc..) and housing from modest single family homes to multi-unit and affordable housing developments, I am always interested in housing trends and the social forces which affect the design process and how people live, work and socialize.

Our firm has had the good fortune over the last few years to have aligned with a local non-profit housing developer (Housing Assistance Corp.) to design and build several housing developments and our team discussions are always about "fostering community" among the "age integrated" residents and building well designed and environmentally responsible housing.

After reading your book, it made me appreciate all the more that we are living in and developing real community buildings and housing for real people "warts and all". Developing affordable housing for lower income individuals and families is a real challenge and NIMBYism, even here on Cape Cod is alive and well. Your book has helped to re-energize my work.

Sincerely.

Rick F

Yarmouthport, MA

Making Suburbia More Livable

"The nation's sprawling suburbs may have been a good place to grow up, but they're a tough place to grow old. Here's how towns are beginning to 'retrofit' their neighborhoods—and what your community might look like in the future."

-- The Wall Street Journal

-- The Wall Street Journal

14 September 2009

More interesting reader comments

An excerpt from a reader who lives in an age-segregated community in San Diego.

-----

"Our 55+ is now 25 years old, and there is serious conflict between what is called the "young-old" group (the next generation recently moved in) vs. the "old-old" group who were the community founders (and are close to very old age). The younger group wants to keep it active and believes that it is just a stage before eventually moving to non-active retirement living. The older group wants to put in/keep in place substantial elements of assisted living."

.....

There is one more item that may be only a peculiarity to our community (unlikely) and that is: Stealing is a problem for the elderly; leave an item unattended and it is very likely to disappear. (I have personally lost two jackets, golf clubs accidently left around the greens, kitchen items brought to pot lucks, etc.) these are not destitute people so it must be for the thrill of it or the attention one gets when caught. (and there is almost no consequence to an older person for getting caught.) the only conclusion I can reach is that there are a number of lonely, unhappy people isolated in their retirement utopias.

-----

-----

"Our 55+ is now 25 years old, and there is serious conflict between what is called the "young-old" group (the next generation recently moved in) vs. the "old-old" group who were the community founders (and are close to very old age). The younger group wants to keep it active and believes that it is just a stage before eventually moving to non-active retirement living. The older group wants to put in/keep in place substantial elements of assisted living."

.....

There is one more item that may be only a peculiarity to our community (unlikely) and that is: Stealing is a problem for the elderly; leave an item unattended and it is very likely to disappear. (I have personally lost two jackets, golf clubs accidently left around the greens, kitchen items brought to pot lucks, etc.) these are not destitute people so it must be for the thrill of it or the attention one gets when caught. (and there is almost no consequence to an older person for getting caught.) the only conclusion I can reach is that there are a number of lonely, unhappy people isolated in their retirement utopias.

-----

09 September 2009

31 August 2009

Reader email defending their chosen lifestyle

Mr. Blechman,

You are to be commended for tackling a tough subject in a thorough and responsible manner. Your book was a good read, filled with interesting perspectives.

I might suggest you consider a sequel to Leisureville and visit our community, Sun City Hilton Head. While the last chapter in your book covers all the arguments we've heard against active adult communities, you did not capture what we are experiencing. We have a high percentage of volunteerism inside and outside our gates; a strong security system that affords residents' their privacy and safety; exposure to cultural activities in nearby Savannah, Hilton Head and Bluffton. We are an ethnically mixed community. Most of us recognize our families experience busy lifestyles and we must establish our own in a new setting. Most of us take an active interest in the realities of the outside world. Hundreds of us volunteer in nearby schools, interact with children there, take part in our respective religious institutions outside our gates, go to Chamber of Commerce meetings to hear speakers about local development, and business opportunities. We're actively participating in our nearby community, yet socializing mostly with those with whom we have commonalities. Many of us are active in the community's governance, serving on committees and encouraging volunteerism.

We have deep discussions about the topics you touch upon. Most of us here have never been happier in our whole lives and for the first time since our busy professional days, we have the time and inclination to enjoy nature, appreciate different perspectives, explore new interests and avail ourselves of wonderful educational opportunities at our nearby University. We really love it here.

Just as an aside, our son is a sociologist and harbored your sentiments when he first heard of our plans to move here. We said it's a "gated community." His response: "Oh good grief, you know that's code for ethnic exclusion." He visited and learned he was wrong. Although, like you, he can't fathom a community sans children and calls it "unreal" like a college campus or an enclave outside the real world, he admits now that he is happy to see us in an environment where we are so happy and busy. All our children seem pleased this community offers a support system and genuine neighborly interest.

I wanted to share my thoughts with you and I hope you will explore Leisureville concerns further and particularly in this incredible community we call Paradise..

Ellie (and Bob) Dixon

Sun City Hilton Head, SC

You are to be commended for tackling a tough subject in a thorough and responsible manner. Your book was a good read, filled with interesting perspectives.

I might suggest you consider a sequel to Leisureville and visit our community, Sun City Hilton Head. While the last chapter in your book covers all the arguments we've heard against active adult communities, you did not capture what we are experiencing. We have a high percentage of volunteerism inside and outside our gates; a strong security system that affords residents' their privacy and safety; exposure to cultural activities in nearby Savannah, Hilton Head and Bluffton. We are an ethnically mixed community. Most of us recognize our families experience busy lifestyles and we must establish our own in a new setting. Most of us take an active interest in the realities of the outside world. Hundreds of us volunteer in nearby schools, interact with children there, take part in our respective religious institutions outside our gates, go to Chamber of Commerce meetings to hear speakers about local development, and business opportunities. We're actively participating in our nearby community, yet socializing mostly with those with whom we have commonalities. Many of us are active in the community's governance, serving on committees and encouraging volunteerism.

We have deep discussions about the topics you touch upon. Most of us here have never been happier in our whole lives and for the first time since our busy professional days, we have the time and inclination to enjoy nature, appreciate different perspectives, explore new interests and avail ourselves of wonderful educational opportunities at our nearby University. We really love it here.

Just as an aside, our son is a sociologist and harbored your sentiments when he first heard of our plans to move here. We said it's a "gated community." His response: "Oh good grief, you know that's code for ethnic exclusion." He visited and learned he was wrong. Although, like you, he can't fathom a community sans children and calls it "unreal" like a college campus or an enclave outside the real world, he admits now that he is happy to see us in an environment where we are so happy and busy. All our children seem pleased this community offers a support system and genuine neighborly interest.

I wanted to share my thoughts with you and I hope you will explore Leisureville concerns further and particularly in this incredible community we call Paradise..

Ellie (and Bob) Dixon

Sun City Hilton Head, SC

25 August 2009

Interesting Reader Email about School Funding

Dear Mr. Blechman,

I just finished reading your book, Leisureville. I am a sixty seven year old retiree who lives in Natick, MA and my wife and I have a small condo in an " age qualified" older gated community in Fort Myers, Florida. I absolutely loved your book. I think it is the best book I have read in a long ,long time. You are a great writer, and you certainly know how to capture attention. Fortunately, my condo complex in Fort Myers and the people there are nothing like the Villages and their residents.

One story I would like to relate to you is as follows. I am a twenty five year elected town meeting representative in the town of Natick, and I remember a few years back we were discussing at Town Meeting whether we should support an override to build a new middle school in town. The town seemed to be divided between the older residents, and the young parents in town.

The older residents were resisting the school override, and the young parents were trying to get support for the schools. On the night of the vote, the young parents showed up in droves, but unfortunately many of them were not elected town meeting members, so they couldn't vote that night. When the discussion, and the vote looked like it would go against the young parents, I got up and told the story that many years ago, when I was a young parent and a town meeting rep, the town was closing schools everywhere in town, and trying to cut the school budget at town meeting in all ways possible, I had made a speech urging the older town meeting reps to help us young parents, and they did. Then I said that now, twenty five years later, I found myself in a new position. Now, I was the older town meeting rep being asked to support the schools. The premise of my argument that night was that one generation must support the next generation, just as I, and other parents, were helped by town meeting twenty five years prior. I told the town meeting that it was our obligation to support the schools, just as you said in your book. I am happy to report that the schools did get the support that night.

Sincerely,

Nick DiMasi

I just finished reading your book, Leisureville. I am a sixty seven year old retiree who lives in Natick, MA and my wife and I have a small condo in an " age qualified" older gated community in Fort Myers, Florida. I absolutely loved your book. I think it is the best book I have read in a long ,long time. You are a great writer, and you certainly know how to capture attention. Fortunately, my condo complex in Fort Myers and the people there are nothing like the Villages and their residents.

One story I would like to relate to you is as follows. I am a twenty five year elected town meeting representative in the town of Natick, and I remember a few years back we were discussing at Town Meeting whether we should support an override to build a new middle school in town. The town seemed to be divided between the older residents, and the young parents in town.

The older residents were resisting the school override, and the young parents were trying to get support for the schools. On the night of the vote, the young parents showed up in droves, but unfortunately many of them were not elected town meeting members, so they couldn't vote that night. When the discussion, and the vote looked like it would go against the young parents, I got up and told the story that many years ago, when I was a young parent and a town meeting rep, the town was closing schools everywhere in town, and trying to cut the school budget at town meeting in all ways possible, I had made a speech urging the older town meeting reps to help us young parents, and they did. Then I said that now, twenty five years later, I found myself in a new position. Now, I was the older town meeting rep being asked to support the schools. The premise of my argument that night was that one generation must support the next generation, just as I, and other parents, were helped by town meeting twenty five years prior. I told the town meeting that it was our obligation to support the schools, just as you said in your book. I am happy to report that the schools did get the support that night.

Sincerely,

Nick DiMasi

05 August 2009

Leisureville interview on WBUR (Boston Public Radio)

Scroll down to "Behind the Gates of a Retirement Community" and then hit the "listen" tab. Enjoy.

27 July 2009

21 July 2009

17 July 2009

Communities sold like Baseball Cards to highest bidder

NOTE: Even more interesting are the reader comments. Apparently the developer has reneged on many of its promises to the community -- not surprising when a "community" is a privately owned for-profit entity, as discussed in Leisureville.

Reader Comments: http://regulus2.azstarnet.com/comments/index.php?id=300964

$8M buys unfinished Hovnanian retirement hub in Vail for Pulte

By Josh Brodesky

ARIZONA DAILY STAR

Tucson, Arizona | Published: 07.15.2009

For all of $8 million, Pulte Homes has purchased an unfinished retirement community in Vail, picking up hundreds of home lots as well as a 14,000 square-foot lodge, two swimming pools, 12 model homes and tennis courts, among other amenities.

Some economists and housing experts have said such fire-sale deals are a key part of the housing recovery, hinting at a bottom as builders and investors move back into the market.

Pulte closed on the deal Tuesday with K. Hovnanian Homes, the original developer of Four Seasons at Rancho del Lago, an active community for residents age 55 and up.

Hovnanian launched the community in February 2008 — despite the housing downturn — planning to build about 500 homes with prices starting in the upper $180,000s. But it only built about 35 homes and finished about 280 lots. Hovnanian's stock has been trading around $2.20 a share.

With the change in ownership, Pulte has renamed the community Del Webb at Rancho del Lago, although the builder will continue to offer Hovnanian's floor plans. Over time, Pulte said it may bring on its own floor plans.

Although new-home construction is at a veritable standstill, Pulte is banking on a growing demand for active retirement housing as more and more baby boomers retire. The recession may slow down that process by years, but the price of the deal, which was paid in cash, gives Pulte plenty of time.

"It was a great deal," said Shawn Chlarson, Pulte's Tucson division president. "As a location, the Vail submarket is physically beautiful. There is a lack of active adult competition down the I-10 corridor."

Pulte management could not be specific about pricing other than saying homes will start in the "mid-100s."

For some time, Pulte had been looking to return to the active community market in Tucson, relying heavily on its well known Del Webb brand.

"I think it's as ideal a vehicle as we could possibly find, short of doing it ourselves, to execute our brand and our lifestyle," Chlarson said.

Amy McReynolds, vice president of operations for Pulte's Tucson division, said Pulte will go about marketing the amenities Hovnanian had already put in — pools, a massive lodge with a gourmet kitchen — as well as its prime location next to the public Del Lago Golf Club.

"Del Webb builds lifestyle communities," she said. "In Tucson we were missing the active adult community, and it's a pretty big profile to not have in Tucson."

Andy Pedersen, regional director of marketing for K. Hovnanian Homes of Arizona, said the nation's sixth-largest builder will "continue to grow throughout Arizona and carry on the tradition of quality, leadership and value."

"Though K. Hovnanian does not have any active communities in the Tucson market, given the acquisition of Four Seasons at Rancho del Lago, we are committed to providing excellent, hands-on customer service to our Tucson homeowners."

To Tim Oakes, designated broker for Del Lago Realty, the biggest selling point for the community is its facilities and amenities, which he described as "absolutely incredible."

Building has stopped in the area, and prices have dropped to the $140,000s, he said. But because of those facilities and eventual growth, "I think it's still a gold mine," Oakes said. "The facilities are great."

More and more, developers and investors are purchasing unfinished developments, which some experts say is a sign the housing market is hitting a bottom.

"I think a lot of (builders) believe there is going to be potential in a couple of years," said Jay Q. Butler, real estate studies director at Arizona State University.

"Pulte, of course, is going to play on the Del Webb name, and, of course, with the aging baby boomers, they feel this is going to be a big growth market in the coming years," Butler said.

University of Arizona economist Marshall Vest said deals like Pulte's or the recent purchase of the unfinished River Walk townhomes development in the Foothills are a key step in forming a bottom for the housing market.

"It is part of the process and it simply reflects that the appetite for risk is returning," he said. "And it's good news because private capital is coming in now and buying up these assets that are really very cheap."

Reader Comments: http://regulus2.azstarnet.com/comments/index.php?id=300964

$8M buys unfinished Hovnanian retirement hub in Vail for Pulte

By Josh Brodesky

ARIZONA DAILY STAR

Tucson, Arizona | Published: 07.15.2009

For all of $8 million, Pulte Homes has purchased an unfinished retirement community in Vail, picking up hundreds of home lots as well as a 14,000 square-foot lodge, two swimming pools, 12 model homes and tennis courts, among other amenities.

Some economists and housing experts have said such fire-sale deals are a key part of the housing recovery, hinting at a bottom as builders and investors move back into the market.

Pulte closed on the deal Tuesday with K. Hovnanian Homes, the original developer of Four Seasons at Rancho del Lago, an active community for residents age 55 and up.

Hovnanian launched the community in February 2008 — despite the housing downturn — planning to build about 500 homes with prices starting in the upper $180,000s. But it only built about 35 homes and finished about 280 lots. Hovnanian's stock has been trading around $2.20 a share.

With the change in ownership, Pulte has renamed the community Del Webb at Rancho del Lago, although the builder will continue to offer Hovnanian's floor plans. Over time, Pulte said it may bring on its own floor plans.

Although new-home construction is at a veritable standstill, Pulte is banking on a growing demand for active retirement housing as more and more baby boomers retire. The recession may slow down that process by years, but the price of the deal, which was paid in cash, gives Pulte plenty of time.

"It was a great deal," said Shawn Chlarson, Pulte's Tucson division president. "As a location, the Vail submarket is physically beautiful. There is a lack of active adult competition down the I-10 corridor."

Pulte management could not be specific about pricing other than saying homes will start in the "mid-100s."

For some time, Pulte had been looking to return to the active community market in Tucson, relying heavily on its well known Del Webb brand.

"I think it's as ideal a vehicle as we could possibly find, short of doing it ourselves, to execute our brand and our lifestyle," Chlarson said.

Amy McReynolds, vice president of operations for Pulte's Tucson division, said Pulte will go about marketing the amenities Hovnanian had already put in — pools, a massive lodge with a gourmet kitchen — as well as its prime location next to the public Del Lago Golf Club.

"Del Webb builds lifestyle communities," she said. "In Tucson we were missing the active adult community, and it's a pretty big profile to not have in Tucson."

Andy Pedersen, regional director of marketing for K. Hovnanian Homes of Arizona, said the nation's sixth-largest builder will "continue to grow throughout Arizona and carry on the tradition of quality, leadership and value."

"Though K. Hovnanian does not have any active communities in the Tucson market, given the acquisition of Four Seasons at Rancho del Lago, we are committed to providing excellent, hands-on customer service to our Tucson homeowners."

To Tim Oakes, designated broker for Del Lago Realty, the biggest selling point for the community is its facilities and amenities, which he described as "absolutely incredible."

Building has stopped in the area, and prices have dropped to the $140,000s, he said. But because of those facilities and eventual growth, "I think it's still a gold mine," Oakes said. "The facilities are great."

More and more, developers and investors are purchasing unfinished developments, which some experts say is a sign the housing market is hitting a bottom.

"I think a lot of (builders) believe there is going to be potential in a couple of years," said Jay Q. Butler, real estate studies director at Arizona State University.

"Pulte, of course, is going to play on the Del Webb name, and, of course, with the aging baby boomers, they feel this is going to be a big growth market in the coming years," Butler said.

University of Arizona economist Marshall Vest said deals like Pulte's or the recent purchase of the unfinished River Walk townhomes development in the Foothills are a key step in forming a bottom for the housing market.

"It is part of the process and it simply reflects that the appetite for risk is returning," he said. "And it's good news because private capital is coming in now and buying up these assets that are really very cheap."

07 July 2009

Interesting Reader Review of Leisureville

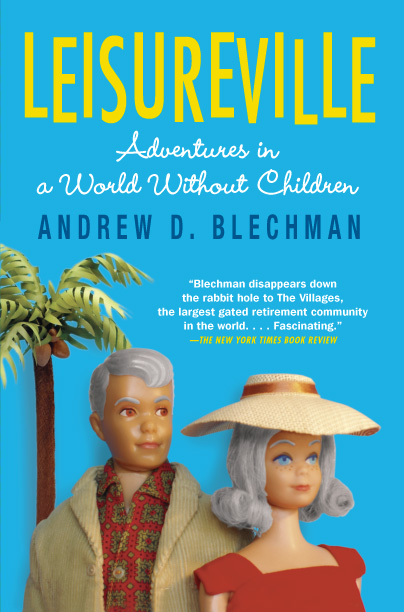

Many Baby Boomers, as we draw closer and closer to the magic number that will allow, or maybe require, us to retire from full-time employment, find ourselves at least a little bit tempted to move into one of the hundreds of age-restricted communities that are popping up all over the country. After all, we reason, we have spent a lifetime paying taxes (including school district taxes for decades after the graduation of our last child), commuting to and from work, and tolerating the unruly behavior and noise of all those kids who live next door and down the street. Don’t we deserve to live our last couple of decades in peace and quiet, among people who share our interests and concerns, and away from the noise and clutter of those not as far into life’s journey as we are?

Andrew Blechman became intrigued by the concept of age-restricted communities when two of his neighbors moved from their longtime home in New England to The Villages, a Florida community designed for people wanting to immerse themselves in a lifestyle of leisure activities and relative isolation from the rest of the world. Blechman became so curious, in fact, that he moved in with his old neighbors for a few weeks to live that lifestyle for himself. Leisureville: Adventures in America’s Retirement Utopias is largely the product of what he learned from the time he spent there.

Anyone considering residence in a community similar to The Villages would be wise to read Blechman’s book because of his firsthand reporting of what it is like to live in a place almost completely dedicated to boiling life’s experiences down to a few simple pleasures. Golfers and those into arts and crafts seem to love the place, as do those who want to cram in as much drinking and sex into the remainder of their lives as possible. But you have other interests, you say? Well, then in all likelihood you will want to avoid the lifestyle offered by The Villages and other communities like it and opt for a more traditional retirement location.

Do you resent being pandered to or brainwashed? If so, you will probably find the community-controlled newspaper, radio and television outlets that pretend that nothing bad ever happens in places like The Villages to be more than a little ludicrous. Even the “reporters” who are supposedly paid to function as news gatherers eventually come to resent all of the censorship necessary to keep smiles on the faces of community residents.

But more importantly, Blechman points out the important social issues that need to be considered before committing to life in any of America’s “Leisurevilles.” Is it right for retirees to yank their support from the communities whose services they have enjoyed for a lifetime? Are they abandoning their generational obligations by deciding not to serve as readily accessible role models to their children, grandchildren and great-grandchildren? Now that they have the luxury of so much free time should they be using some of it to better their communities by working for social or structural changes from there?

Those are just a few of the questions that Blechman asks in his book. There are good arguments to be made on both sides of the issue as to whether or not age-restricted settings like The Villages are a good thing or a bad thing. For some people, these communities offer exactly the lifestyle most suited to their retirement years. For others the very thought of moving into such a community is mind numbing, at best, and horrifying, at worst.

Leisureville moved me one giant step closer to deciding what kind of retirement setting will be best for me and my wife. But I also came away from the book with the understanding that, although age-segregated, gated communities have no appeal to us, they will appeal to many others – and are absolutely perfect for some.

Personally, I am certain that we would be bored in a community where golf, alcohol and casual sex are such prominent parts of the lifestyle that everything else seems secondary. For us it is more important to remain close to family and to enjoy the benefits of living in a diverse community with so much more to offer than golf courses, bars and community centers. I sincerely believe that aging is as much mental as it is physical, and that the mental part is much easier to govern while surrounded by family, a diverse group of fellow citizens and neighbors, museums, university access, and live sports and entertainment choices.

Andrew Blechman became intrigued by the concept of age-restricted communities when two of his neighbors moved from their longtime home in New England to The Villages, a Florida community designed for people wanting to immerse themselves in a lifestyle of leisure activities and relative isolation from the rest of the world. Blechman became so curious, in fact, that he moved in with his old neighbors for a few weeks to live that lifestyle for himself. Leisureville: Adventures in America’s Retirement Utopias is largely the product of what he learned from the time he spent there.

Anyone considering residence in a community similar to The Villages would be wise to read Blechman’s book because of his firsthand reporting of what it is like to live in a place almost completely dedicated to boiling life’s experiences down to a few simple pleasures. Golfers and those into arts and crafts seem to love the place, as do those who want to cram in as much drinking and sex into the remainder of their lives as possible. But you have other interests, you say? Well, then in all likelihood you will want to avoid the lifestyle offered by The Villages and other communities like it and opt for a more traditional retirement location.

Do you resent being pandered to or brainwashed? If so, you will probably find the community-controlled newspaper, radio and television outlets that pretend that nothing bad ever happens in places like The Villages to be more than a little ludicrous. Even the “reporters” who are supposedly paid to function as news gatherers eventually come to resent all of the censorship necessary to keep smiles on the faces of community residents.

But more importantly, Blechman points out the important social issues that need to be considered before committing to life in any of America’s “Leisurevilles.” Is it right for retirees to yank their support from the communities whose services they have enjoyed for a lifetime? Are they abandoning their generational obligations by deciding not to serve as readily accessible role models to their children, grandchildren and great-grandchildren? Now that they have the luxury of so much free time should they be using some of it to better their communities by working for social or structural changes from there?

Those are just a few of the questions that Blechman asks in his book. There are good arguments to be made on both sides of the issue as to whether or not age-restricted settings like The Villages are a good thing or a bad thing. For some people, these communities offer exactly the lifestyle most suited to their retirement years. For others the very thought of moving into such a community is mind numbing, at best, and horrifying, at worst.

Leisureville moved me one giant step closer to deciding what kind of retirement setting will be best for me and my wife. But I also came away from the book with the understanding that, although age-segregated, gated communities have no appeal to us, they will appeal to many others – and are absolutely perfect for some.

Personally, I am certain that we would be bored in a community where golf, alcohol and casual sex are such prominent parts of the lifestyle that everything else seems secondary. For us it is more important to remain close to family and to enjoy the benefits of living in a diverse community with so much more to offer than golf courses, bars and community centers. I sincerely believe that aging is as much mental as it is physical, and that the mental part is much easier to govern while surrounded by family, a diverse group of fellow citizens and neighbors, museums, university access, and live sports and entertainment choices.

04 July 2009

Email from a former Villages employee -- quite interesting!

Dear Mr. Blechman,

I just finished reading "Leisureville," and it inspired me to write you. I worked for The Villages in the "old days," in the 1980s and '90s, for what was then The Orange Blossom Sun.

As such, I was fascinated -- and disturbed -- by your interview with the young reporters now working for the Daily Sun. The idea of discarding back issues of the paper, destroying one's reporting notes and having one's computer routinely scrubbed by the company would have been unthinkable to us.

Harold Schwartz's philosophy was to hire good people to run his departments, then stay out of their way. At the Sun, that person was our publisher, an Orange Blossom Gardens (OBG for short) resident named Adelaide Carpenter, a retired journalist from Hawaii. In addition to running stories, press releases and columns written by resident volunteers, our staff covered various happenings within the community, as well as Lady Lake government. When Harold was running things, we were never told what to print, or chastised for reporting events which might cast the developer in an unfavorable light. When someone climbed a fence on the back side of OBG property, stole a golf cart and burglarized a number of houses, we ran the story without being censored.

That changed when Harold bowed out from running the company day-to-day in about 1994, and Gary Morse took over, after the community had been renamed The Villages. At one point, Gary decided he wanted to de-annex the original Orange Blossom Gardens section from Lady Lake to form his own government (this was before the CDD was formed). We were told that an entire issue of the paper was to be devoted to presenting a clearly biased, one-sided presentation of the issue favorable to the developer. To her credit, Ad Carpenter resisted, and went to Harold with her objections. Eventually, a compromise was reached in which we were allowed to cover the story from both sides in the body of the paper, but a special four-page insert pushing de-annexation was published. When the referendum came, the majority of residents in the Lady Lake portion of The Villages voted to remain tied to the city. I'd like to think our straight reporting had something to do with that.

I'm also proud to say that we were not intimidated by Gary, who Ad derisively called "H. God." At one point, Gary said to us, "I'm not spending all this money so you can play newspaper." To which Ad responded, "We're professionals. We're not playing."

Ultimately, of course, Gary won, and not just in our department. At the Recreation Department, which had been run since the beginning of Harold's involvement in OBG by a pair of twin sisters named Cricket and Janet Jordan, Gary installed the wife of the corporate attorney in a specially created position to "supervise" the Jordans. Eventually, Gary convinced Harold that the Jordans had been disloyal to him and were working to subvert his vision of The Villages -- which wasn't true -- and they were fired. The employees who had worked for years with the Jordans either got fired themselves or resigned in protest. One Rec Department underling who survived the blood-letting was a relative newcomer, an enthusiastic but, to my recollection, none-too-bright young man named John Rohan. Yes, that John Rohan.

Similar blood-lettings occurred in all the departments, as people loyal to Harold were let go. Eventually, that included Ad and me. We tried to start our own independent newspaper, but were unable to secure financing. Eventually, I pursued a career opportunity in the Florida Keys. Four years later, I received a call from Ad telling me she had been diagnosed with cancer, but was optimistic she could beat it. Less than a month later, her daughter called me to tell me Ad had passed away.

At the end of "Leisureville," you speculate about what H. Gary Morse might think about what he has wrought. I knew the man fairly well. I suspect what was true then is true now: He pays lip-service to playing by the rules, but he's not above changing the rules when it suits his purposes. Harold was gregarious. He cared about the residents, he identified with them, and he enjoyed mingling with them. He would never have had a private skybox put into the movie theaters. Gary, on the other hand, sees the residents as a necessary nuisance. If he could find a way to make millions of dollars off The Villages without catering to them, he'd do it. He cares about no one but himself, and about nothing but the bottom line.

Harold wanted to build a community where working class retirees could buy in for a modest price and live like millionaires. Gary wants a community where you have to be a millionaire to gain entry.

I apologize for rambling, but your book sparked all these memories. One last story to illustrate Gary's persona and how he sees the elements of the empire he has created as mere tools to serve his own ends:

In 1992, when Bill Clinton made his first run for the presidency, he made one of his famous "Bus Tours" through Central Florida, starting in Daytona Beach, heading over to Orlando, then coming north to Ocala. His route would take him up Highway 441, the highway which cuts through the heart of The Villages. We thought it would be a good story for us if we could arrange a stop at The Villages. Ad called Rep. Everett Kelley, the State Representative who helped get the golf cart bridge built (and who was a Democrat at the time), and he thought it would be a good opportunity for Mr. Clinton to address seniors' issues, so he arranged it. Clinton drew a good-sized crowd, and The Villages TV station's anchor, Kevin Coughlin, and his cameraman somehow evaded the Secret Service cordon, mixed in with the press corps covering Clinton, and got an interview with him. Needless to say, they were proud of their coup, and kept it in the news loop for a couple of weeks. Then one day Gary called the head of VNN. He had seen the interview of Clinton still running on the station, and he was furious: "Get that son of a bitch off my TV station!" The interview was pulled immediately.

We knew that was the beginning of the end for us.

Thank you for writing this book.

I just finished reading "Leisureville," and it inspired me to write you. I worked for The Villages in the "old days," in the 1980s and '90s, for what was then The Orange Blossom Sun.

As such, I was fascinated -- and disturbed -- by your interview with the young reporters now working for the Daily Sun. The idea of discarding back issues of the paper, destroying one's reporting notes and having one's computer routinely scrubbed by the company would have been unthinkable to us.

Harold Schwartz's philosophy was to hire good people to run his departments, then stay out of their way. At the Sun, that person was our publisher, an Orange Blossom Gardens (OBG for short) resident named Adelaide Carpenter, a retired journalist from Hawaii. In addition to running stories, press releases and columns written by resident volunteers, our staff covered various happenings within the community, as well as Lady Lake government. When Harold was running things, we were never told what to print, or chastised for reporting events which might cast the developer in an unfavorable light. When someone climbed a fence on the back side of OBG property, stole a golf cart and burglarized a number of houses, we ran the story without being censored.

That changed when Harold bowed out from running the company day-to-day in about 1994, and Gary Morse took over, after the community had been renamed The Villages. At one point, Gary decided he wanted to de-annex the original Orange Blossom Gardens section from Lady Lake to form his own government (this was before the CDD was formed). We were told that an entire issue of the paper was to be devoted to presenting a clearly biased, one-sided presentation of the issue favorable to the developer. To her credit, Ad Carpenter resisted, and went to Harold with her objections. Eventually, a compromise was reached in which we were allowed to cover the story from both sides in the body of the paper, but a special four-page insert pushing de-annexation was published. When the referendum came, the majority of residents in the Lady Lake portion of The Villages voted to remain tied to the city. I'd like to think our straight reporting had something to do with that.

I'm also proud to say that we were not intimidated by Gary, who Ad derisively called "H. God." At one point, Gary said to us, "I'm not spending all this money so you can play newspaper." To which Ad responded, "We're professionals. We're not playing."

Ultimately, of course, Gary won, and not just in our department. At the Recreation Department, which had been run since the beginning of Harold's involvement in OBG by a pair of twin sisters named Cricket and Janet Jordan, Gary installed the wife of the corporate attorney in a specially created position to "supervise" the Jordans. Eventually, Gary convinced Harold that the Jordans had been disloyal to him and were working to subvert his vision of The Villages -- which wasn't true -- and they were fired. The employees who had worked for years with the Jordans either got fired themselves or resigned in protest. One Rec Department underling who survived the blood-letting was a relative newcomer, an enthusiastic but, to my recollection, none-too-bright young man named John Rohan. Yes, that John Rohan.

Similar blood-lettings occurred in all the departments, as people loyal to Harold were let go. Eventually, that included Ad and me. We tried to start our own independent newspaper, but were unable to secure financing. Eventually, I pursued a career opportunity in the Florida Keys. Four years later, I received a call from Ad telling me she had been diagnosed with cancer, but was optimistic she could beat it. Less than a month later, her daughter called me to tell me Ad had passed away.

At the end of "Leisureville," you speculate about what H. Gary Morse might think about what he has wrought. I knew the man fairly well. I suspect what was true then is true now: He pays lip-service to playing by the rules, but he's not above changing the rules when it suits his purposes. Harold was gregarious. He cared about the residents, he identified with them, and he enjoyed mingling with them. He would never have had a private skybox put into the movie theaters. Gary, on the other hand, sees the residents as a necessary nuisance. If he could find a way to make millions of dollars off The Villages without catering to them, he'd do it. He cares about no one but himself, and about nothing but the bottom line.

Harold wanted to build a community where working class retirees could buy in for a modest price and live like millionaires. Gary wants a community where you have to be a millionaire to gain entry.